FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Online Banking

ID Theft Protection

Identity theft is any crime that involves someone wrongfully obtaining and using another person’s personal data in a fraudulent manner, usually to steal money, open new credit cards, apply for loans, rent apartments and commit other crimes—all using your identity. The identities of roughly nine million Americans are stolen each year. Below are resources and information to help educate clients to see the signs before it happens. Also, you can enroll in Deluxe ID Theft and Fraud Protection Plan as an extra layer of protection. If you do become a victim of identity left, please use this contact list to report

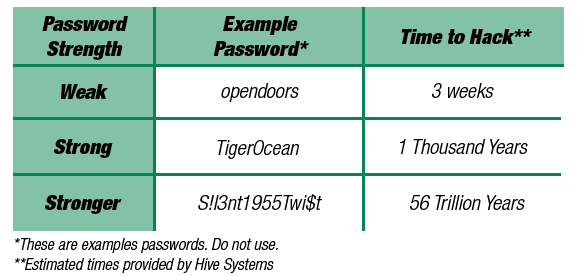

Is Your Password Strong Enough?

A strong and complex password makes it significantly harder for cybercriminals to access your accounts, protecting personal and sensitive information. Cyber attacks often involve automated tools that can quickly identify weak passwords.

A strong password is considered to have the following characteristics:

- At least 15 characters

- Upper and lowercase letters

- Numbers

- Special characters (@, !, #, -, etc.)

Once any password is found in a breach, your sensitive information is in jeopardy and is susceptible to instant access by cybercriminals. It is extremely important that you do not reuse the same password for multiple logins. Reusing passwords anywhere online is unsafe. While convenient, storing passwords in your browser poses significant security risks, as anyone with access to your device or a compromised browser can easily access your stored credentials.

In addition to having a strong password, it is always best practice to check your accounts regularly and enable any alert services that are provided.

For more information about password safety, please visit the Hive Systems.

Working to Prevent Financial Exploitation

First Bank is thrilled to announce that we are one of the banks that AARP has recognized with the BankSafe Trained Seal for the steps we have taken to help stop financial exploitation. Click here to learn more.

Tax Time is Show Time for Scammers

Fraudsters take advantage of you this time of year to try to steal your money or private information by pretending to be IRS agents or state tax department representatives.

The IRS wants you to know:

- They will first mail you a bill about taxes owed before making any phone call

- They will give you the opportunity to question any taxes it says you owe

- They will never call to demand immediate payment

- They will never ask for credit or debit card numbers over the telephone

- They will never threaten to have you arrested for not paying

- They won’t require a specific payment method, such as a prepaid debit card or wire transfer

Don't let tax scams trick you into losing your money or sensitive information!

Fraud Prevention: What Can You Do?

Scammers are always looking for new victims, and seniors are on their list.

These crooks use many ways to target your money or personal information. Here are some things to look for and some suggestions about what to do if you think you might be a victim.

Don’t rush into financial decisions. If you’re unsure about anything, ask for an explanation or say you need more time to think about it. Don’t feel pressured to make snap decisions.

Don’t give out personal information such as account numbers, your Social Security number, or your debit or credit card numbers unless you’re sure it’s necessary.

Lock up or hide your checkbook, bank statements, cash or other important documents if other people will be in your home.

Don’t panic if someone calls you and threatens to turn off your utilities or close your bank account unless you pay them money right away. Scammers will often do this and ask you to pay with a wire transfer or a gift card. If you’re unsure, hang up and call your bank or utility company at their official phone number and explain what happened.

Ask for references before hiring anyone, and don’t give workers information about your accounts.

Pay with a credit or debit card if you have them. These methods give you more protection than cash or checks.

Talk to your banker, financial advisor, attorney, a trusted family member or friend if you have questions about financial issues.

Use online banking and email or text alerts to monitor your accounts. If you’re unsure how to do that, ask your banker for information about learning how to use them.

Check your credit report at one of the three main credit bureaus for possible problems at least once a year. You can do it for free by starting at annualcreditreport.com.

If you think you might be an elder financial abuse victim, contact your bank and file a report with your local law enforcement agency and contact your local or state adult protective service agency to let them know what happened.

Being cautious can keep your money and information safe from crooks.

Beware of Fictitious Wire Instructions

Beware of Sneaky Wire Transfer Email Fraud

Ever sent a wire transfer for a business deal, only to realize later it was a hoax? Scammers are always looking for new methods, and wire transfer fraud, a specific type of Business Email Compromise (BEC), is a growing threat for both businesses and individuals.

Let’s look at what wire transfer email fraud is, how it works, its impact on small businesses, and how to protect yourself from falling victim to such scams. This guide is especially relevant for small business owners, IT professionals, finance managers, and freelancers who are looking to safeguard their operations.

Understanding Wire Transfer Email Fraud

Wire transfer email fraud is a sophisticated scam that targets businesses and individuals by tricking them into wiring money to fraudulent accounts. Fraudsters typically gain access to email systems through phishing or malware and then use compromised accounts to send fake wire transfer instructions.

One common tactic is the "updated instructions" scam, where scammers send revised wire transfer details to redirect funds to their accounts.

How the Scam Works

Imagine you're finalizing a legitimate transaction via email and receive wire transfer instructions. Later, you get another email, seemingly from the same person, with "updated" or "corrected" instructions. This new email might have a slightly different sender address or contain a sense of urgency, but it contains a different receiving account for the wire and sometimes new contact information for the sender.

Here's the catch: it's a fake email! Scammers often compromise legitimate email accounts or create look-alike addresses to trick you into sending money to their accounts.

Wire transfer email fraud usually begins with a phishing attack or malware infection that grants scammers access to an email account.

Once inside, they monitor communications to identify ongoing transactions and then send fake wire transfer instructions. They often impersonate a trusted vendor or colleague to make the request appear legitimate.

Is Wire Transfer Fraud the Same as CEO Fraud?

Wire transfer fraud is a broad category of scams that includes CEO fraud. While both are types of Business Email Compromise, CEO fraud is when scammers impersonate high-level executives to request urgent wire transfers from an employee in their own corporation.

Both types of fraud involve a compromised email system, where hackers have gained access to one or more accounts.

Gaining Access to Email Systems

Scammers use various methods to gain access to email systems, including phishing emails, malicious links, and infected attachments. Once they have access, they can monitor communications, identify targets, and execute their fraudulent schemes.

Why Do Scammers Use Wire Transfers?

While wire transfers are a perfectly legitimate and secure method to send money, they are a preferred payment method for scammers because once sent, they are nearly impossible to reverse. While good news for the scammer, this is very bad news for your business! Be as cautious with your wire transfers as you would be with an equivalent pile of cash.

The Impact on Small Businesses

Small businesses often lack the robust cybersecurity measures that larger organizations have in place. Limited resources and staff make them easier targets for scammers. Falling victim to this scam can have devastating consequences, causing financial losses and damaging your reputation.

Why Small Businesses Are Vulnerable

Small businesses are prime targets because they often have less robust security measures and rely heavily on email communication. Additionally, small businesses may not have formal processes in place for verifying wire transfer instructions, increasing the risk of falling for scams.

Financial and Reputational Damage

Email malware and wire transfer fraud can result in significant financial losses. Recovering stolen funds can be challenging, and businesses may face cash flow issues as a result. Additionally, the reputational damage can be severe, as clients and partners may lose trust in the business.

What to Look for in Potentially Fraudulent Wire Transfer Emails

When it comes to your day-to-day priorities, weeding out spam email is not the most demanding or exciting job, but it is still an important step in your cybersecurity plan. Even one lapse in security can have disastrous consequences, so it’s vital to keep on the lookout for these problems. Let’s break down the signs so you and your team know how to use your business emails responsibly.

Variations of the Scam

Scammers may use different approaches, such as sending fake invoices or impersonating vendors. It's essential to stay vigilant and verify any wire transfer requests you receive, preferably over the phone and never through the email address used to send the request. These scams can look slightly different, depending on the industry:

- Mortgage wire fraud: This could happen when someone purchases property and uses a wire transfer to send the downpayment. A follow-up email is sent with “updated” or “corrected” instructions.

-

CEO fraud: A message apparently from someone higher up in your organization asks for a wire transfer to be sent.

- Vendor payments: A vendor or supplier sends new instructions for payment and/or updated contact information.

Common Tactics Used in Wire Transfer Fraud

Scammers often employ social engineering tactics to manipulate victims. They may create a sense of urgency, use familiar language, or reference genuine transactions to make their requests seem legitimate.

Red Flags to Watch Out For

Be cautious of emails that rely on any of the following tricks:

- Urgency: Emails pressuring you to act fast and send money immediately.

- Sender Discrepancies: Slight variations in email addresses or names compared to previous communications. Come from unfamiliar email addresses or domains that closely resemble legitimate ones.

- Unexpected Changes: Requests to send money to a different account than usual. Contain new or updated wire transfer instructions.

- Suspicious Attachments or Links: Avoid clicking on links or downloading attachments from unknown senders.

- Poor Grammar or Unusual Language: Unprofessional language or grammatical errors can be a sign of a scam.

Protecting Yourself from Wire Transfer Scams

The best defense is always a good offense, and when you know what to look for, it becomes a lot easier to protect your business from these types of scams. It starts with having the right tools at hand: your knowledge of the threat, and the security procedures you put in place.

Verification is Key

Never send money based solely on instructions or contact information provided in the email, as scammers can easily manipulate it. Before sending any wire transfer, always verify the instructions through a trusted method.

Here’s how to verify:

- Trusted Phone Numbers: Call the sender using a phone number you have on record, not the one provided in the email.

- Double-Check Details: Verify bank account details and other information directly with the recipient.

- In-Person Verification: If possible, verify instructions in person for important transactions.

Cybersecurity Measures

Since BEC scams start with a compromised email system, implementing strong cybersecurity practices is a crucial step in preventing wire transfer fraud. Keeping hackers out of your email system is your first line of defense.

A few important things to remember:

- Avoid clicking on suspicious links or downloading attachments from unknown senders.

- Use robust antivirus and anti-malware software and keep them up to date.

- Create unique, strong passwords and change them regularly.

- Train employees in email security best practices, such as recognizing phishing attempts and verifying wire transfer instructions.

- Consider using two-factor authentication for an extra layer of security.

What to Do if You Suspect Fraud

Wire transfers move quickly, so if you suspect you’ve been the victim of fraud, it’s vital that you move fast. Take immediate action to protect your livelihood and that of your clients, vendors, and customers.

Act Quickly

If you suspect that you've fallen victim to wire transfer fraud, respond immediately:

- Contact your financial institution to report the suspected fraud and attempt to recover the funds.

- Ask your financial institution to contact the receiving institution. They may be able to freeze the funds.

- Explain the situation and provide details about the suspicious email.

Report the Scam

Reporting the incident helps authorities track scam trends and potentially recover funds. You should promptly report the scam to the relevant authorities:

- File a report with the Federal Trade Commission (FTC)

- Report the email to the Internet Crime Complaint Center (IC3)

- Contact your local police department or FBI office.

Additional Tips for Businesses

Protecting your business from wire transfer fraud and other email scams is about the security of your network – both the technological side as well as the people you work with. Here are a few ideas on how to improve security for your business:

- Employee Training: Regularly train employees on email security best practices to identify and avoid email fraud attempts.

- Culture of Verification: Encourage a culture of verification within your company. Double-check any financial requests received via email.

- Dual Control: Require multiple approvals before wire transfers can be sent. This will provide an additional opportunity to consider the legitimacy of the transfer.

- Multi-Factor Authentication: Consider implementing multi-factor authentication for critical financial accounts.

Don't Get Scammed

Wire transfer email fraud is a serious threat that can have devastating consequences for businesses. By understanding how these scams work and implementing robust security measures, you can protect yourself and your organization.

Taking these proactive steps can significantly reduce the risk of falling victim to wire transfer email fraud. Stay vigilant, educate your team, and prioritize the security of your financial transactions.

For more information on wire transfer fraud prevention, visit the FBI’s page on Business Email Compromise.

No Love for Romance Scammers

As your social media and mailboxes fill up with New Year’s greetings, you might see some unfamiliar names. Are the messages from long-lost friends or romance scammers trying to get close? Click here for some things to watch for.

Tips to Help Protect You and Your Money

Scammers are constantly trying to steal your money and your personal information, and they use a variety of ways to try to trick you. Scammers often pretend to be from an organization you might know and trust (such as an FDIC-insured bank) and try to get your personal information. FDIC can help you verify whether a website is a fake bank website or the legitimate website of an FDIC-insured bank. Click here to read more from the FDIC.

Stop. Call. Verify.

Business email compromise (BEC)—also known as email account compromise (EAC)—is one of the most financially damaging online crimes. It exploits the fact that so many of us rely on email to conduct business—both personal and professional. Criminals send an email message that appears to come from a known source making a legitimate request, like in these examples:

- A vendor your company regularly deals with sends an invoice with an updated mailing address.

- A company CEO asks her assistant to purchase dozens of gift cards to send out to employees.

Here are a few ways to protect yourself:

- Verify payment and purchase requests in person or by calling a verified phone number.

- Do not call a phone number included within an email without verifying if it's legitimate.

- Be especially wary if the requestor is pressing you to act quickly.

- Carefully examine the email address, URL, and spelling used in any correspondence.

- Be careful with what information you share online or on social media.

How to report:

- Contact your financial institution immediately and request that they contact the financial institution where

the transfer was sent. - Next, contact your local FBI field office to report the crime and file a complaint with the Internet Crime

Complaint Center (IC3).

Mail Fraud Prevention

Mail theft-related check fraud generally pertains to checks stolen from the U.S. Mail. Fraud, including check fraud, is the LARGEST source of criminal proceeds and represents one of the most significant money laundering threats to the United States.

What can you do?

- If you're expecting a check via mail, follow up if it does not arrive on time

- Monitor your accounts in real-time with Online and Mobile Banking

- Watch for any missing mail including bank statements, reoccurring bills, etc.

- Add Account Alerts for any transactions that occur on your account

Card Fraud Text Alerts

Card Fraud Text Alerts will notify you immediately if a suspicious transaction is detected on your debit card by sending a text to your cell phone. This allows you to instantly and easily review transactions that may be fraudulent and help protect your account. Click here to read how it works!

Account Alerts

The best defense against account fraud is knowing when fraudulent activity takes place.

Our Account Alerts system provides stronger security by delivering real-time account alerts. Receive alerts via online banking, text, email and push notifications. Alerts help you manage your account by monitoring your account balances and activity, getting deposit and withdraw notifications, controlling security alerts and more.

For detailed instructions on how to set-up Account Alerts for your accounts, please view the video below. If you have any questions, please contact one of our experienced Bankers at (847) 432-7800.

Credit Reporting Companies

- Equifax – 1(800) 525-6285

- Experian – 1(800) 397-3742

- Transunion – 1(800) 680-7289

- Free annual credit report – ANNUALCREDITREPORT or 1(877) 322-8228

Federal Trade Commission

- Report identity theft: FTC.GOV/COMPLAINT or 1(877) 438-4338

- Identity theft info: WWW.FTC.GOV/IDTHEFT

- Internal Revenue Service (IRS)

- Identity Protection Specialized Unit – 1(800) 908-4490

- Identity theft info: IRS.GOV/IDENTITYTHEFT

Social Security Administration

SOCIALSECURITY.GOV type “Fraud” in the search box 1(800) 269-0271

Opt Out

Opt out of pre-screened offers of credit or insurance: OPTOUTPRESCREEN.COM or 1(888) 567-8688

US Postal Service

Mail theft or identity theft issues – 1(800) 275-8777 or 1(877) 876-2455